After six completed bid rounds, the CNH and the SHCP have moved up rapidly in the learning curve. They have a better market understanding of how the oil industry values underground hydrocarbon resources.

The National Hydrocarbons Commission (Comisión Nacional de Hidrocarburos or “CNH”) is responsible for conducting acreage tenders and the Ministry of Finance (Secretaría de Hacienda y Crédito Público “SHCP” or Treasury) is responsible of managing Mexico’s E&P fiscal regime. After six completed bid rounds, they have moved up rapidly in the learning curve. The CNH and the SHCP have a better market understanding of how the oil industry values underground hydrocarbon resources. Mexican authorities have learned to apply common tender and fiscal practices widely used in Colombia, Brazil and the US Gulf of Mexico (US GOM), among others. These common practices consist in not only offering smaller blocks, but also favoring upfront signature bonuses over other future government take instruments (Royalties and/or Governmental Production Share). We expect this trend to continue as Mexican geology is “de-risked” by new knowledge and smooth contract management is demonstrated.

The advantage for a resource owner in awarding acreage based on signature bonus or bid bonds is two-fold: 1) The operator pre-pays petroleum rent even if no oil and gas is produced; and 2) a signature bonus is a sunken cost that allows small fields to be developed, even when the total government take is high (referring to small fields). The downside or drawback is that when geological risks or other kind of risks are high, signature bonuses tend to be too small; nevertheless Mexican Hydrocarbons Law already has incorporated some progressive component with royalties/share adjustments.

Generally, the main variable in the License or Production Sharing Agreements (PSA) awarding process is additional government take, over and above the minimum set in the Law, followed by investment commitments. Often the numerical values/formulas of these variables are designed to result in tie bids by one or more bidders. A tie breaking mechanism is also common in the industry. The most popular tie-breaking mechanism is an upfront cash payment or signature bonus.

Awarding all blocks in a given tender is not always the main objective of the authorities; these objectives sometimes include to promote loyal players, to attract new participants or to promote national content. The very first acreage tender (called Round 1, call 1 or R 1.1)[1] in Mexico under the new Hydrocarbons Law met one key criteria set by the Mexican Government. It demonstrated that the Reform was not giving the nation’s resources too cheap. The first Round (R 1.1) awarded only 2 out of the 14 offshore blocks auctioned for the tendered PSA. The CNH and the SHCP decided to capture the largest possible rent the market would offer by defining a minimum acceptable bid that was not disclosed until all offers had been submitted. Not just the drop in the price of oil explains these results but also because the authorities misjudged the market or were too cautious by not giving the impression to the public that they were leaving much rent uncollected. The minimum share of “profit oil” earmarked for State Participation set for most cases at 40%, and four of the bids presented by participants fell below those values and were discarded according to the tender rules. Had the referred values been published before, some of that threshold or low bids could have been adjusted for a successful award. It was then clear that Mexican authorities were going through an important learning curve that was reflected in the results of that bid.

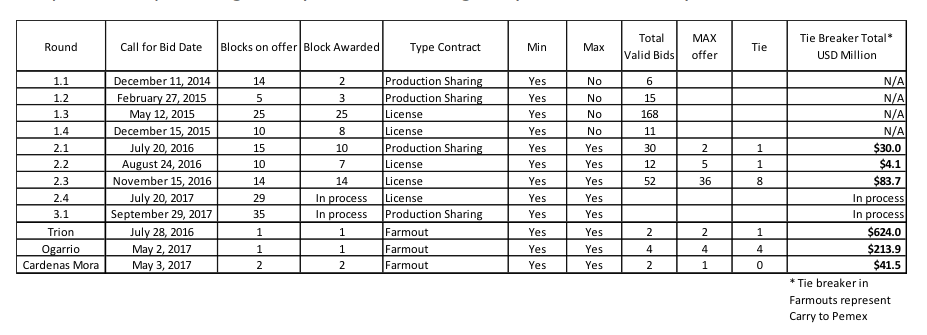

Rounds 1.2 and 1.3 (see table) went much better. The next major lesson was evident in the results of R 1.3. The R 1.3 was to tender 25 small marginal fields. This call was designed for small operators as well as to encourage local industry to play a role in the oil industry. Again, the objective was met at a cost: out of 25 blocks offered, all 25 were awarded. Here the success was not the 100% block awarded but the participation on many Mexican companies. Local inexperienced operators generally overbid rendering many fields contractually uneconomic.

This time the CNH published the minimum value for bidding variables to avoid repeating the former experience of bid 1.1; three blocks out of five were awarded with dangerously high bids. As indicated above, the third call or bid 1.3 was interesting. Out of 25 small onshore producing (or had already produced) blocks, all 25 were awarded, -again- with very high offer values (as high as 85.69% additional royalty over the royalty mandated in the Hydrocarbons Law) submitted by the participants. In order to attract local players, the authorities lower the required qualifications for submitting bids to encourage local companies. Given that with one or two exceptions, Mexican companies do not have experience evaluating the economic value of this type of contracts. Under Mexican law, in contrast to that of other countries, it is prohibited that participants negotiate a lower value once such value has been submitted as part of the bid.

The third lesson came during the first “Farmout” tender to select a potential partner for Pemex to develop Trion field, an ultra-deep water discovery conducted in parallel with Round 1.4. Here the objective was not the capture of maximum government take but a high cash carry to Pemex in operating the Deepwater field. The award criteria were designed with a low government take but the key parameter was the amount of carry the new Pemex partners were willing to fund. The two bidders BHP and BP bid 632 million and 600 million respectively.

The lessons learned are:

1.- No need to be extremely cautious on setting minimum government take since the market will determine that level.

2.-Extremely high bids will result in contractors not performing and potentially abandoning the field.

3.-If the acreage tendered is attractive, it is feasible to obtain cash now (as opposed to high government take that materialize after this administration is out of office).

_

In other countries, such as the United States of America, the award mechanism requires only one parameter: it is signature bonus, however the US GOM blocks are small (50km2) and the geology of the area is well known to a multitude of players ensuring that way strong competition. Currently, Mexican blocks are quite bigger but a trend moving toward smaller blocks may be the path that the CNH will choose to follow in future bidding processes. Another procedure that is noteworthy mentioning here is the one used in Brazil also awards Licenses (conventional areas not applicable to Pre-Salt deposits) based primarily on highest signature bonus offers. A second variable with much lower weight is the bidder’s commitment to acquire locally produced equipment, materials and services.

The next set of tenders under Ronda 2 came all with minimum and maximum values for key award parameters and a tie-breaking mechanism by submitting a cash offer. Four tenders composed this Ronda. Of those four, one was for onshore blocks and two more offshore blocks in shallow waters, and one still under process for deep waters. As a result of the experience in Round one and the Farmout Trion, the CNH and the SHCP began publishing relatively low thresholds for the maximum bid parameters and reducing the variability of Additional Investment parameters. The result is that many bidders tie and in order to break the tie, a cash bonus is called for.

As can be seen in the table, the different calls for tenders in Round 2: In R 2.1 two bids out of 30 bids offered the maximum, producing 1 tie breaker; in Round 2.2 five out of 12 bids were the maximum parameter resulting in one more tie-breaker, round 2.3 was an eye opener; out of 52 individual bids for 14 blocks, 36 were the maximum causing 8 tie-breakers. The government has received US$ 115 million dollars as a result 3 tenders and Pemex has been offered US$870 million in carry to develop on Deepwater field and two onshore fields.

Further detail on the bid patterns can be obtained by contacting RDA.

[1] In Mexico the so-called Rounds1 and 2 are divided in 4 different calls for bids, for simplicity we will number here Round 1.1, Round 1.2… Round 2.1, Round 2.2 and so on. In total 8 bidding processes have been launched divided in two Rounds. Additionally, CNH conducts terns for finding a partner of Pemex in the “Strategic Associations” better known as “Farmouts”